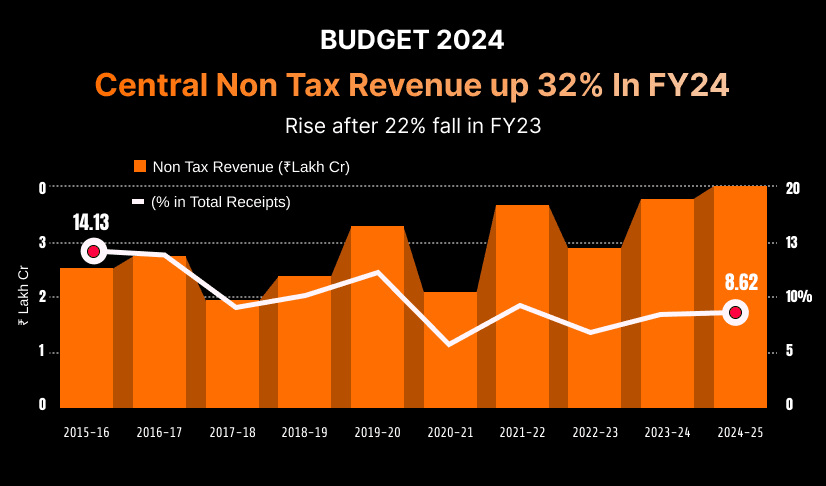

Did you know that in some years, India's non-tax revenue has crossed ₹3 lakh crore? That’s money earned without collecting taxes. While tax revenue grabs all the headlines, understanding what is non tax revenue reveals how governments keep things running.

From fines to profits, this blog breaks it down in plain English, no jargon. And once you see how it works, you’ll never see it the same again.

Understanding Non-Tax Revenue: What It Is and Why It Matters

When we talk about government revenue, taxes usually take the spotlight. But the truth is, governments get their money from more than just taxes. A significant part of their income comes from non tax revenue, that is, funds earned without directly taxing citizens. For example, in India, about 15-20% of the total public revenue is generated this way.

So, what is non tax revenue? Simply put, it’s government income from sources other than compulsory taxes like income or sales tax. These include:

Fees for government services such as passports or driving licences

Fines and penalties imposed for legal violations

Dividends and profits from government-owned companies and public sector enterprises

Interest earned on government investments

Rent and royalties from government-owned assets

Governments developed these revenue streams to:

Diversify their income sources and avoid over-reliance on taxes

Maintain a steady flow of financial resources for ongoing public needs

Fund essential services and infrastructure without increasing the tax burden on citizens

Tax Revenue vs Non-Tax Revenue: Key Differences

To fully understand non tax revenue, it’s important to see how it differs from tax revenue, the more familiar form of government income.

Aspect | Tax Revenue | Non-Tax Revenue |

Definition | Compulsory money collected from individuals and businesses | Income earned from government operations and regulatory activities |

Examples | Income tax, corporate tax, sales tax, customs duties | Fees for services (passports, licences), fines, dividends, interest on investments |

Nature | Mandatory and legally enforced | Voluntary or regulatory, based on services or penalties |

Primary Use | Major source of government earnings to fund public expenditure | Supplementary funds to support projects without increasing taxes |

Source of Funds | Directly from taxpayers | From government services, fines, and public sector enterprises |

Impact on Citizens | Direct tax burden | Usually linked to specific services or penalties |

Example:

Paying your annual income tax contributes to tax revenue.

Paying a passport fee or a traffic fine contributes to non tax revenue.

Both types of revenue are essential for a balanced public finance system, helping governments meet their financial needs efficiently.

Broad Classification of Non Tax Revenue

To understand non tax revenue better, it helps to know that it generally falls into three broad categories based on how the income is generated:

Administrative Revenue: Income earned through routine government services and regulatory functions. This includes various charges, application fees, and service-related payments.

Commercial Revenue: Earnings from government-owned businesses or enterprises. This includes income from the sale of goods, services, or returns on investments made by public sector undertakings.

Capital and Miscellaneous Revenue: This includes one-off or irregular receipts such as fines, penalties, grants from foreign institutions, royalties, and property income. These support the government’s fiscal stability without placing a recurring tax burden on citizens.

Sources of Non Tax Revenue

Non tax revenue isn’t a single income stream; it’s a collection of diverse revenue sources that come from various government functions and assets. These sources ensure the government has regular, alternative financial resources beyond tax collection.

Here’s a general breakdown of the sources of non tax revenue found in most countries:

1. Fees for Public Services

Governments provide services to citizens and charge for them. These payments are not taxes, but service-based charges.

Examples:

Passport and visa application fees

Driving licence fees

Registration fees for businesses or properties

University or exam fees in government institutions

These fees fall under public sector income and help recover administrative and operational costs.

2. Fines and Penalties

When citizens or businesses violate laws, they pay fines. These are punitive charges that also act as a deterrent.

Examples:

Traffic violation fines

Environmental violation penalties

Court fines and judicial penalties

This form of government income supports the fiscal balance without taxing compliant citizens.

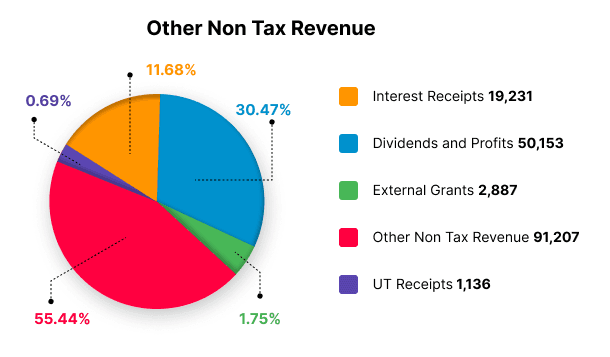

3. Dividends and Profits from Public Sector Undertakings (PSUs)

Governments often own or invest in companies. The profits from these are returned to the treasury.

Examples:

Profits from Indian Oil, SBI, LIC, etc.

Dividends from government shareholdings in listed companies

These public sector earnings form a valuable revenue stream.

4. Interest on Loans and Investments

Governments lend money to state bodies, public sector units, or even foreign countries. They also invest in securities.

Examples:

Interest on loans given to state governments or PSUs

Returns from investments in bonds, securities, etc.

This provides revenue stability and is an efficient use of idle funds.

5. Rent and Royalties

When governments allow public assets or natural resources to be used commercially, they charge rents or royalties.

Examples:

Royalties from mining, oil extraction, or forest use

Rent from government-owned buildings and land

6. Licensing and Permit Charges

Governments regulate several industries and charge businesses for operational permissions.

Examples:

Liquor and telecommunication licences

Broadcasting permits

Casino and gaming licences

The Sources and Real World Impact of Non Tax Revenue in India

India’s non tax revenue is collected by both the Central and State Governments through various channels. Here's how it comes in:

Source Type | Description | Real Examples in India |

Fees and User Charges | Citizens pay for accessing specific public services | Passport fees, examination fees (UPSC, SSC), land registration charges |

Fines and Penalties | Paid for breaking laws or violating regulations | Traffic fines, pollution control fines |

Dividends from PSUs | Profits from government-owned enterprises | ONGC, Coal India, LIC dividend payouts |

Interest Income | From loans to states, PSUs, and investments | Interest from loans to Air India (when it was state-run), or state development loans |

Rents and Royalties | For the use of natural resources or public land | Royalties on coal mining, oil drilling, and forest timber extraction |

Licences and Permits | Payments for regulatory approvals | Liquor licences, telecom spectrum auctions, mining leases |

Asset Sales/Disinvestment | Selling stakes in public sector companies | Partial stake sale of BPCL, Air India divestment |

Why This Matters for India’s Economy

Non-tax revenue contributes to government funds without increasing the burden on ordinary citizens. Here’s how:

Funds infrastructure projects like highways, railways, and airports

Supports public services such as education, sanitation, and rural development

Reduces fiscal deficit by easing reliance on borrowing

Enhances revenue diversification, making the system less vulnerable to tax shortfalls

In FY 2023–24, India expected around ₹2.4 lakh crore from non tax revenue, showing its growing importance in public finance.

The Hidden Engine of Public Funds

Unlike tax revenue, which knocks on every citizen’s door, non tax revenue works in the background, a parking ticket here, a telecom auction there, quietly contributing to fiscal balance and reducing the strain on taxpayers. In India, where managing public expenditure is an ongoing challenge, these alternative earnings play a powerful role in stabilising the economy and funding progress, much like how tax planners help you manage personal finances.

So the next time you wonder how the government runs without raising taxes every year, remember, it’s not always about taking more; sometimes it's about earning better.

Glossary of Key Terms

Term | Meaning |

Tax Revenue | Income earned by the government through mandatory taxes like income tax, GST, etc. |

Non Tax Revenue | Income earned from sources other than taxes, such as fees, fines, and dividends. |

Dividends | A share of profits paid to the government by public sector companies. |

Fees | Charges collected by the government in exchange for services (e.g., passport fee). |

Fines | Penalties imposed for breaking rules or laws. |

Fiscal Balance | The state of government income matches or exceeds its expenditure. |

Public Finance | The government manages a country's income, spending, and debt load. |

Revenue Streams | Different ways in which the government earns income. |

Government Investments | Financial activities by the government to earn returns (e.g., stakes in companies). |

Public Sector | Government-owned organisations and enterprises. |