With the introduction of the income tax e-portal, the Income Tax Department of India has made tax filing more transparent, secure, and user-friendly. If you're a first-time filer or someone who used the older portal, this guide will help you understand how to smoothly transition to the new income tax portal, use its features, and complete your filing with confidence.

Why a New ITR Portal?

The older system, while functional, had limitations. Users often faced delays, login issues, and confusion over form types. The revamped income tax e-portal aims to address these concerns. Key objectives include:

Faster processing of returns

Quick and seamless refund crediting

A clean, taxpayer-friendly interface

Real-time dashboards and integrated services

It is part of the Central Board of Direct Taxes (CBDT) initiative to modernise Indian tax systems.

Key Features of the New Income Tax Portal

1. Pre-filled ITR Forms

The income tax e portal auto-fills your income, interest, and tax details from sources like Form 26AS, TIS, and AIS. This reduces manual work and errors.

2. Faster Refunds

If your bank account is pre-validated and return verified, refunds are often credited within a few days.

3. Unified Dashboard

Track all your filings, notices, pending actions, and communications in one place.

4. Multiple Payment Options

You can pay tax using UPI, net banking, debit/credit cards, and even NEFT/RTGS through your bank.

5. 24x7 Support

Live chat, video tutorials, and a detailed FAQ section are available to help.

6. Mobile Compatibility

The portal is responsive and optimised for tablets and smartphones.

These features make income tax filing online not just convenient, but also more secure and error-free.

Step-by-Step Guide to Using the New Income Tax Portal

Let’s walk through each step in detail so you’re well prepared.

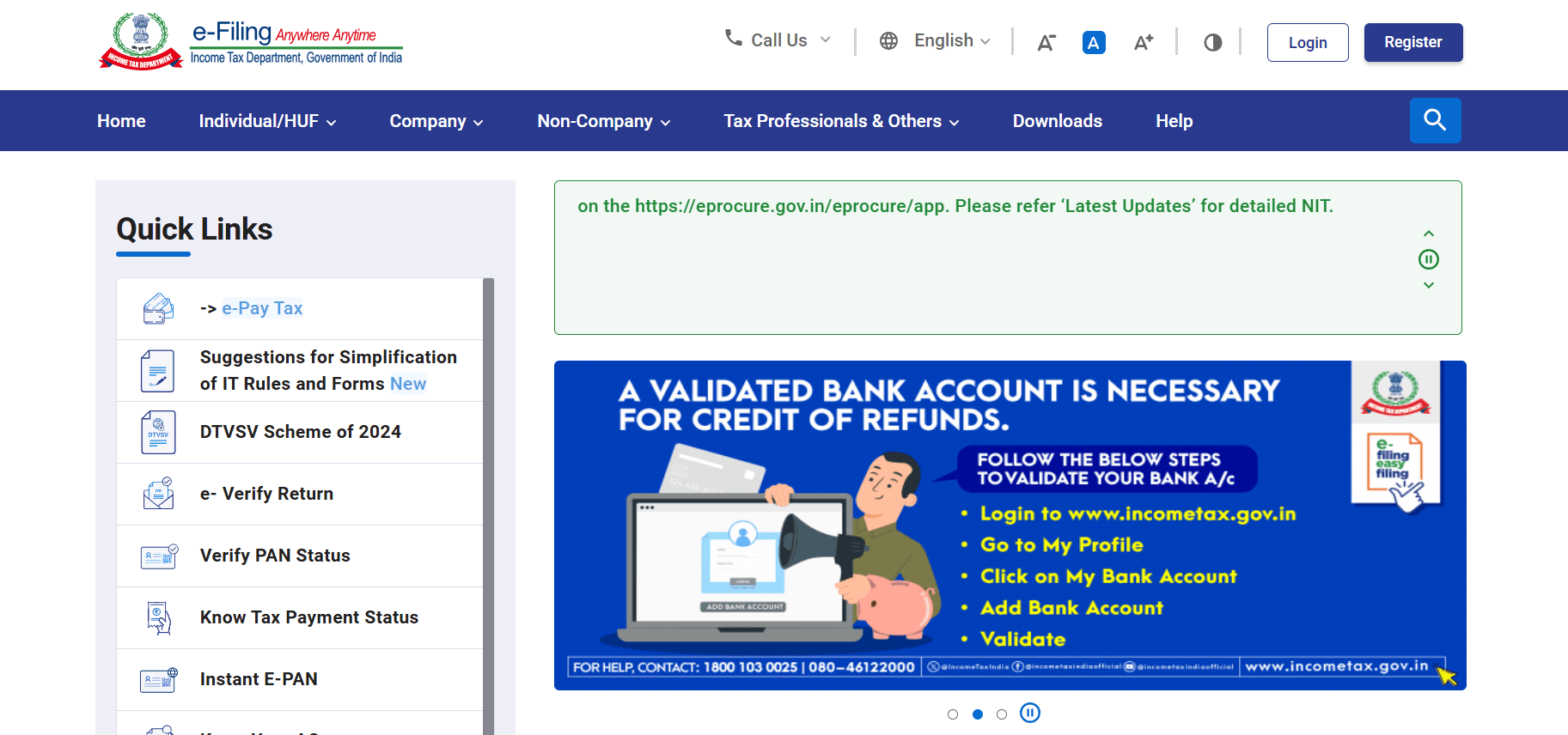

Step 1: Registration / Login

Visit www.incometax.gov.in & click ‘Register’ (top right)

Enter your PAN as your User ID

Choose your user type (Individual, HUF, or other)

Fill in basic details like your name, DOB, mobile number, and email

Verify with the OTP sent to your mobile/email

Set a secure password

Existing Users:

Click on ‘Login’

Enter your PAN and password

Complete the captcha and OTP if prompted

Tip: Make sure your PAN is linked to Aadhaar to avoid login or validation issues.

Step 2: Update Profile Information

Once logged in, navigate to My Profile:

Check your mobile number and email – update if needed

Pre-validate your bank account for receiving refunds

Add Aadhaar and digital signature (if applicable)

Fill in your communication address, occupation, and marital status

Step 3: Start Filing

Go to e-File > Income Tax Returns > File Income Tax Return

Choose:

Assessment Year: For income earned in FY 2023-24, select AY 2024-25

Online or Offline filing: First-time filers should opt for the online mode

Status: Individual / HUF / Firm

Step 4: Choose the Correct ITR Form

The form depends on your income type. There are seven forms available so select the correct ITR form option.

Beginner Note: If you're salaried and don’t have capital gains, ITR-1 is generally applicable.

Step 5: Review Pre-Filled Data and Enter Additional Information

The portal may already include:

Salary details from Form 16

Interest income from banks

TDS deducted

Details from AIS (Annual Information Statement)

Check everything:

Add deductions under 80C, 80D, etc.

Input any other income (freelancing, rental, etc.)

Cross-check bank account details

Step 6: Preview and Submit Return

Before submission:

Click "Preview Return"

Ensure all figures are correct

Fix any validation errors shown

Click Submit to proceed.

Step 7: E-Verify Your Return

This is mandatory. You have these options:

Aadhaar OTP: Quickest way if your Aadhaar is linked to your mobile

Net Banking: Log into your bank, select e-Verify

Bank Account EVC: A code is sent to your registered mobile

Digital Signature Certificate (DSC): Mandatory for audit cases

Once verified, you will see an Acknowledgement (ITR-V). Download and save it.

Common Issues and How to Fix Them

1. Login Problems

Clear browser cache and cookies

Use Chrome or Firefox

Try incognito/private window

2. Return Not Submitting

Don’t file during peak hours (like late evenings near deadline)

Use a stable internet connection

3. E-Verification Fails

Aadhaar not linked to mobile? Use Net Banking

Still stuck? Use the offline method (send signed ITR-V to CPC Bengaluru) or learn how to handle an income tax notice if issues persist

Tips for a Smooth Filing

Link PAN and Aadhaar before filing

Pre-validate your bank account and check the IFSC code

Keep your Form 16, AIS, and TIS ready

Review every field, especially deductions and exemptions

Save your progress every 10 minutes to avoid data loss

File early to avoid last-minute stress

Conclusion

The new income tax portal is a welcome shift towards simplifying taxation in India. With user-centric features, faster refunds, and robust support, filing taxes is now less stressful. Even if you're a beginner, following the step-by-step guide will help you feel confident.

Disclaimer: This information provided is intended for general informational purposes only. It is not a substitute for professional advice or guidance. For personalised recommendations or specific concerns, please consult a certified professional.