When you sell an investment for more than what you paid for it, the profit you make is called a capital gain. And yes, this profit is taxable. Understanding how capital gains tax works in India is essential for anyone looking to invest wisely and keep more of their hard-earned returns.

What is Capital Gains Tax?

Capital gain taxation in India refers to the tax levied on profits earned from selling capital assets such as:

Stocks and equity shares

Real estate properties

Gold and jewellery

Bonds and debentures

Cryptocurrency

The amount of tax you pay depends on two key factors:

How long have you've held the asset before selling (holding period)

The type of asset you've sold

Based on the holding period, capital gains are classified into two categories:

Short-Term Capital Gains (STCG)

These are profits from assets sold after holding them for a relatively brief period.

Long-Term Capital Gains (LTCG)

These are profits from assets held for a longer duration before selling.

The Holding Period: When is it Short-Term vs Long-Term?

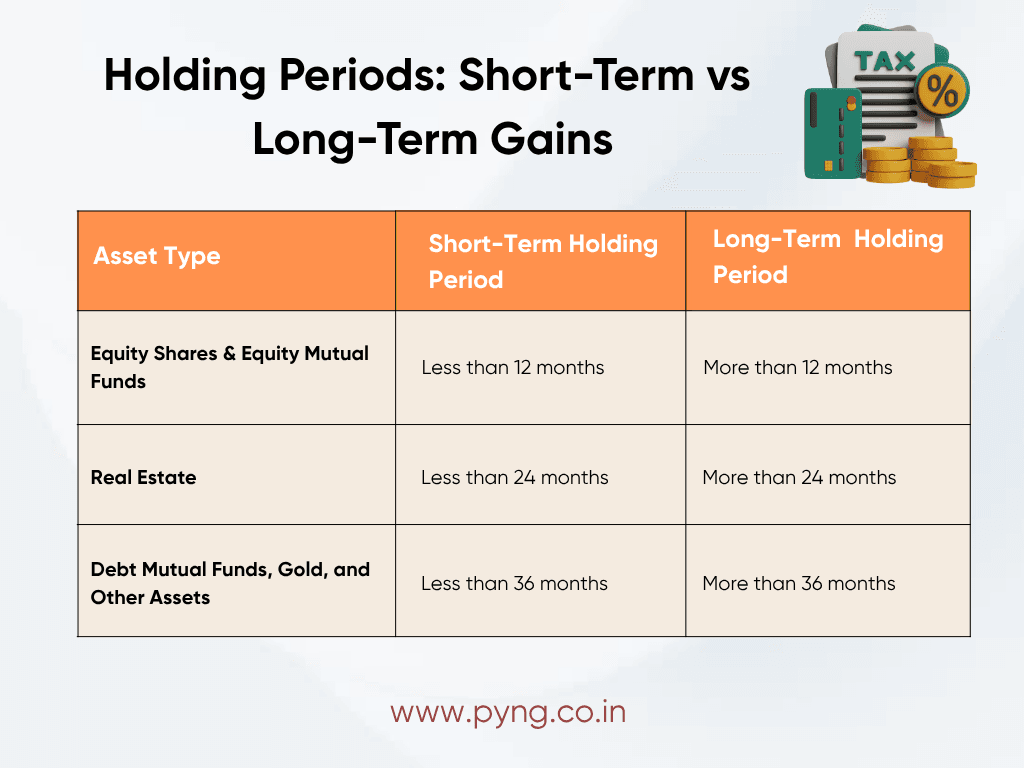

Different assets have different holding periods to qualify as long-term:

Understanding this distinction is crucial because short term capital gains tax rates differ significantly from long term capital gains tax rates.

How Short-Term Capital Gains Are Taxed

Short term capital gains tax rates vary based on the type of asset sold:

1. For Equity Shares and Equity-Oriented Mutual Funds

If you sell equity shares or equity mutual funds within 12 months, the profits are considered STCG and taxed at a flat rate of 20% (provided Securities Transaction Tax or STT has been paid at the time of both purchase and sale).

For example, if you buy shares worth ₹50,000 and sell them after 8 months for ₹70,000, your STCG would be ₹20,000. The tax payable would be 20% of ₹20,000, which equals ₹4,000.

2. For Other Assets (Real Estate, Gold, Debt Funds)

STCG on these assets is added to your total income and taxed according to your income tax slab rate. This means the tax rate could range from 5% to 30% depending on your total income.

Important Notes on STCG:

No deductions under Sections 80C to 80U are allowed against STCG from equity shares and equity mutual funds.

For STCG on other assets, you can claim deductions under Chapter VI-A to reduce your taxable income.

STCG is calculated simply as (Sale Price - Purchase Price - Expenses on Transfer).

How Long-Term Capital Gains Are Taxed

Long term capital gains tax offers more favourable rates compared to STCG, making it advantageous to hold investments for longer periods.

1. For Equity Shares and Equity Mutual Funds

LTCG exceeding ₹1,25,000 in a financial year is taxed at 12.5% without indexation benefits.

This means the first ₹1,25,000 of LTCG from equity in a financial year is completely tax-free. Only the amount exceeding this threshold is taxed at 12.5%.

For example, if your LTCG from equity shares is ₹2,00,000 in a financial year, only ₹75,000 (₹2,00,000 - ₹1,25,000) will be taxable, resulting in a tax of ₹9,375 (12.5% of ₹75,000).

2. For Real Estate, Debt Funds, Gold, and Other Assets

These assets are taxed at 20% with indexation benefits.

What is Indexation?

Indexation adjusts your purchase price for inflation, effectively reducing your taxable gain. This is a significant benefit that can substantially lower your tax liability.

Example of Indexation Benefit: Imagine you purchased a property in 2010 for ₹30 lakhs and sold it in 2024 for ₹70 lakhs.

Without indexation, your capital gain would be ₹40 lakhs (₹70 lakhs - ₹30 lakhs).

With indexation (assuming CII for 2010 was 167 and for 2024 is 348):

Indexed cost = ₹30 lakhs × (348 ÷ 167) = ₹62.51 lakhs

Taxable gain = ₹70 lakhs - ₹62.51 lakhs = ₹7.49 lakhs

Tax at 20% = ₹1.5 lakhs (approximately)

Without indexation, your tax would have been ₹8 lakhs (20% of ₹40 lakhs), but with indexation, it's reduced to just ₹1.5 lakhs.

Exemptions and Deductions on Capital Gains

The capital gain rules in India provide several exemptions that can help you legally reduce or eliminate your tax liability:

Section 54: For Residential Property

Applicable to: LTCG from the sale of a residential house property

Exemption condition: Invest the capital gains in purchasing or constructing another residential property

Timeline: Purchase within 1 year before or 2 years after the sale, or construct within 3 years after the sale

Maximum exemption: Equal to the amount invested in the new property

Section 54F: For Other Assets

Applicable to: LTCG from the sale of any asset other than a residential house (like stocks, gold, commercial property)

Exemption condition: Invest the entire sale proceeds (not just the capital gains) in purchasing or constructing a residential house

Timeline: Same as Section 54

Important restriction: You should not own more than one residential house (other than the new one) at the time of sale.

Section 54EC: For Land and Buildings

Applicable to: LTCG from the sale of land or a building

Exemption condition: Invest in specified bonds (like REC or NHAI bonds)

Timeline: Within 6 months from the date of transfer

Maximum investment: ₹50 lakhs

Lock-in period: 5 years for the bonds

Note: Only gains legally classified as long-term are eligible; depreciable assets no longer qualify.

Section 54EE: For Any Long-Term Capital Asset

Applicable to: LTCG from the sale of any long-term capital asset

Exemption condition: Invest in specified units of the startup funding schemes

Timeline: Within 6 months from the date of transfer

Maximum investment: ₹50 lakhs

Lock-in period: 3 years for the investment

Note: Very few funds have been notified under this section, so its use is limited.

Capital Gains Account Scheme (CGAS)

If you plan to claim exemption under Section 54, 54F, or 54EC but haven't yet invested the money, you can temporarily deposit it in a Capital Gains Account with any scheduled bank. This deposit must be made before the due date of filing your income tax return.

Strategies to Minimise Your Capital Gains Tax In India

1. Plan Your Holding Period

Wait until your investments qualify as long-term before selling them to benefit from lower tax rates and indexation benefits.

2. Harvest Your Losses

Offset your capital gains with capital losses. If you've made losses on some investments, you can use them to reduce your taxable capital gains.

3. Stagger Your Sales

Instead of selling all your investments in a single financial year, spread them across multiple years to take advantage of the ₹1,25,000 exemption for equity LTCG each year.

4. Leverage Tax-Saving Sections

Utilise Sections 54, 54F, and 54EC strategically by planning your investments in alignment with your asset sales.

5. Gift Assets to Family Members

Consider gifting assets to family members in lower tax brackets before selling them. While gifting itself isn't taxable, the recipient will pay capital gains tax as per their tax bracket when they sell.

Plan Smart, Pay Less

Understanding capital gain taxation in India might seem complex initially, but mastering these basics can save you significant amounts in taxes. By planning your investments with tax planners, aware of the capital gain rules, holding periods, and available exemptions, you can maximise your after-tax returns while staying fully compliant with the law.

Remember that tax laws change periodically, so it's always advisable to consult a tax professional for personalised advice tailored to your specific financial situation.

Capital Gains Tax India 2025 | Short-Term vs Long-Term Explained

Learn the differences between short-term and long-term capital gains, tax rates, exemptions, and strategies to minimise your tax liability.