As another financial year begins, lakhs of Indian taxpayers are facing a dual challenge: how to reduce taxable income and grow their wealth.

This is where Equity Linked Savings Schemes (ELSS) come in. Let’s explore the pros and cons of ELSS funds and how to choose the best one to invest in.

What Are ELSS Funds?

ELSS are mutual funds that primarily invest in equity, offering a smart way to learn how to invest in ELSS funds in India. This gives your money a chance to grow more than traditional savings options, especially if you stay invested for a few years.

Pros and Cons of Investing in ELSS Funds

Aspect | Advantages of ELSS | Disadvantages of ELSS | When It Works & When It Doesn’t |

Tax Benefits | Eligible for deduction under Section 80C up to ₹1.5 lakh per financial year. | Deduction limit is capped at ₹1.5 lakh, shared with other 80C instruments (like PPF, EPF, life insurance). | Advantage: Radhika, a salaried employee with ₹1.5L left to invest under 80C in March, opts for ELSS and saves ~₹45,000 in tax (assuming 30% slab). Disadvantage: Arjun already used up 80C via EPF and life insurance, so his ELSS investment won’t save him additional tax. |

Lock-in Period | Shortest lock-in (3 years) among all 80C options. Provides partial liquidity. | 3-year lock-in applies to each SIP instalment, not the entire investment. Cannot redeem early. | Advantage: Neha invests a lumpsum of ₹1L in March 2022 and redeems in March 2025—perfect timing for her home downpayment. Disadvantage: Karan invested monthly via SIP; when he needs money in June 2025, only SIPs till June 2022 are free to redeem. |

Returns Potential | Market-linked returns—historically 10–15% annualised over long term. | Returns are not guaranteed. Can be volatile in short term due to equity exposure. | Advantage: Priya stayed invested for 7 years and earned 13% CAGR—her corpus grew from ₹5L to ~₹11.3L. Disadvantage: In 2020, Aman exited after 3 years with only 2% CAGR due to a bear market phase. |

Wealth Creation | Best suited for long-term wealth building. Compounding works strongly over 5–10 years. | Those seeking capital protection or short-term gains may be disappointed. | Advantage: Ramesh invested ₹10K/month for 10 years and built a corpus of ₹23L+ for his child’s education. Disadvantage: Sanya invested ₹1.5L for 3 years, hoping to use it for her wedding, but the market downturn reduced her corpus to ₹1.35L. |

Diversification | Invests across sectors and market caps (large, mid, small). Reduces company/sector-specific risk. | Fund performance is still market-dependent; some funds may have high concentration in specific sectors. | Advantage: Akshay’s ELSS fund was diversified across BFSI, pharma, and IT, shielding it during sector-specific downturns. Disadvantage: Deepa’s ELSS fund was tech-heavy and underperformed when tech stocks corrected. |

Professional Management | Fund managers actively rebalance portfolio based on market trends and fundamentals. | High dependence on the skill of the fund manager; poor choices can underperform. | Advantage: Mirae Asset Tax Saver delivered stable returns due to prudent fund management. Disadvantage: A less popular ELSS fund changed managers thrice in 2 years, leading to inconsistent performance. |

SIP Option | SIPs allow rupee cost averaging—ideal for salaried individuals. Lowers entry barrier. | SIPs complicate lock-in period tracking, especially when money is needed urgently. | Advantage: Shweta started ₹5K/month SIP; over 5 years, she smoothed out market volatility and earned healthy returns. Disadvantage: Tarun needed emergency funds in year 4, but his SIPs from year 2 onward were still locked. |

Capital Gains Taxation | LTCG (Long-Term Capital Gains) up to ₹1L/year is tax-free; beyond that taxed at 10% (no indexation)—lower than FD. | Gains above ₹1L/year are taxable even though investment is long-term. No inflation adjustment. | Advantage: Meera redeemed ₹90K gains in a year—paid zero tax. Disadvantage: Rohit redeemed with ₹2L gains; paid ₹10,000 as LTCG tax on ₹1L excess. |

Expense Ratio | Direct plans have low expense ratios (~0.5%–1%), which means more returns for the investor. | Regular plans via agents have higher expense ratios (~1.5%+), which eat into profits. | Advantage: Vinay invested in a direct ELSS fund and saved ~₹15K over 5 years in fees alone. Disadvantage: Kriti used a distributor’s regular plan and unknowingly paid 1.8% annually as charges. |

Ease of Access & Tracking | Easily available via online platforms, mutual fund houses, and apps. NAVs updated daily. | Requires monitoring over time; some investors prefer passive instruments like PPF or FD. | Advantage: Tushar uses a mobile app to auto-invest and track ELSS NAVs monthly. Disadvantage: Renu finds mutual fund tracking overwhelming and prefers FD’s fixed return. |

Alt text: Financial Advisors on Pyng

Top 5 ELSS Funds with Strong 10-Year Performance (2014 to 2024)

1. Kotak ELSS Tax Saver Fund

10-Year Return: ~15.5% per annum

Why It’s a Top Performer:

Consistent Growth: This fund has steadily grown investors’ money over the long term, beating many peers.

Balanced Portfolio: It invests across large, mid, and small companies, balancing growth and stability.

Strong Management: Managed by experienced professionals who adjust the portfolio as market conditions change.

Low Volatility: The fund’s approach helps reduce big ups and downs, making it suitable for steady wealth creation.

2. Aditya Birla Sun Life ELSS Tax Saver Fund

10-Year Return: ~11.6% per annum

Why It’s a Top Performer:

Diversified Investments: The fund spreads investments across different sectors and company sizes, reducing risk.

Track Record: It has a long history of navigating different market cycles, showing resilience during tough times.

Stable Returns: Delivers reliable performance, which is important for long-term goals like retirement or children’s education.

3. Tata ELSS Tax Saver Fund

10-Year Return: ~15.6% per annum

Why It’s a Top Performer:

Strong Long-Term Returns: One of the best in the category for 10-year performance.

Quality Stock Picks: Focuses on companies with strong fundamentals, which helps generate stable returns.

Experienced Team: Managed by a team with a proven track record in equity investing.

4. ICICI Prudential ELSS Tax Saver Fund

10-Year Return: ~14.1% per annum

Why It’s a Top Performer:

Consistent Outperformance: Beats its benchmark and many competitors.

Disciplined Strategy: Follows a well-defined investment process, focusing on quality businesses.

Risk Management: Balances risk and reward, making it a good choice for first-time equity investors.

5. HDFC ELSS Tax Saver Fund

10-Year Return: ~14.2% per annum

Why It’s a Top Performer:

Large-Cap Focus: Invests mainly in big, stable companies, which reduces volatility.

Conservative Approach: Suitable for investors who prefer steady growth with lower risk.

Strong Reputation: Managed by one of India’s most respected fund houses, known for prudent investment practices.

(Source: money control)

How to Study and Select a Diversified Fund

Check Sector Allocation: Look for funds that invest across several industries, not just one or two.

Look at Company Size Mix: A good balance between large, mid, and small companies is ideal.

Review Top Holdings: Make sure no single company or sector dominates the portfolio.

Past Performance: See how the fund performed in both good and bad markets.

Fund Manager Experience: Experienced managers are better at handling market ups and downs.

Let’s take the Kotak ELSS Tax Saver Fund as an example to understand how diversification helps reduce investment risk.

How is Kotak ELSS Tax Saver Fund Diversified?

This fund has diversified in 3 aspects:

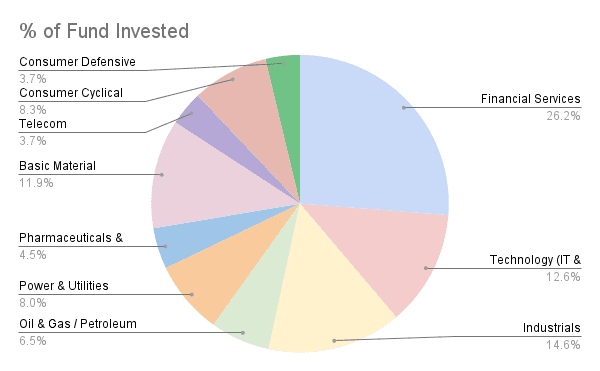

By Sectors (Industries)

The fund invests in many different sectors rather than focusing on just one. Here’s a breakdown of where your money goes (as of recent data):

Source: (INDmoney)

By Company Size (Market Capitalisation)

The fund also spreads investments across:

Company Size | % of Fund Invested |

Large Cap | ~70-75% |

Mid Cap | ~15% |

Small Cap | ~9-14% |

Large Cap are big, stable companies, while mid & small Cap companies have higher growth potential, but more risk. This mix means you get the stability of large companies and the growth potential of smaller ones.

By Number of Stocks

The fund holds shares in many different companies, not just a few. Top holdings include HDFC Bank, ICICI Bank, Infosys, State Bank of India, and Axis Bank, but no single company makes up more than 10% of the fund.

Why Does This Matter for You?

Reduces Risk: If one sector or company performs poorly, others can make up for it.

Smoother Returns: Diversification helps avoid big ups and downs in your investment value.

Exposure to Growth: You benefit from growth in different parts of the economy, not just one area.

Professional Management: Fund managers constantly monitor and adjust the mix to keep the balance right.

Is ELSS Right for You?

ELSS funds offer a unique blend of tax savings, equity growth, and wealth creation potential. While they come with inherent market risks and no fixed returns, they are still one of the most efficient 80C options for investors who can tolerate volatility and stay invested for the long term.

If you’re looking to diversify your tax-saving strategy with help from financial consultants, ELSS funds could be the right fit.

Pros and Cons of ELSS Funds | Know the Best ELSS Funds to Invest

Explore the pros and cons of ELSS funds, India’s popular tax-saving mutual funds under Section 80C. Learn how to pick the right funds for your financial goals.