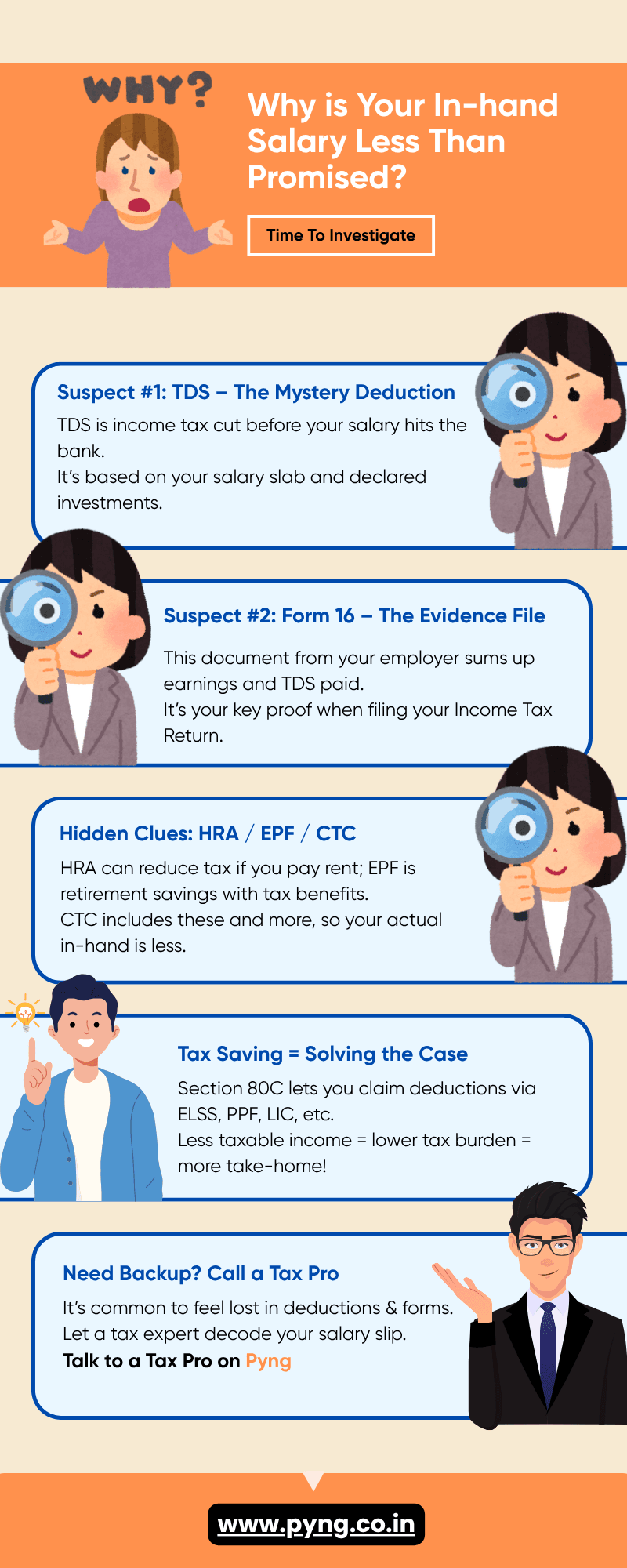

Finally getting a good salary package—congratulations. The first salary credit feels great, but the moment you see your salary slip, you might be wondering: ‘What’s this TDS? Why is my salary less than expected?’Argh.

Welcome to the world of taxes.

Understanding tax terms is essential for managing your money better, saving on taxes, and avoiding tax troubles. Let’s break it down and make tax filing easy for beginners.

1. Basic Tax Terms You Should Know First

Before we dive into forms and processes, let’s understand the language of taxes.

1.1 TDS Meaning

TDS stands for Tax Deducted at Source.

TDS is a system where your employer deducts a certain amount from your salary before it’s credited to your account. This amount is then paid directly to the government as advance tax on your behalf.

It’s visible in your salary slip.

It’s linked to your PAN (Permanent Account Number).

At the end of the financial year, you can compare how much tax was deducted against how much you actually owe. If excess was paid, you can claim a refund.

Example: If you earn ₹40,000 per month, your employer may deduct ₹2,000 as TDS depending on your annual income and investments.

➡️ TDS ensures steady tax collection and reduces tax evasion.

1.2 PAN (Permanent Account Number)

Your PAN is like your tax identity card, similar to a Tax Identification Number (TIN) for businesses. All your income, TDS, tax filings—everything is connected to it.

Never share it casually.

Ensure it is linked to your bank accounts and Aadhaar.

1.3 Financial Year vs Assessment Year

Financial Year (FY): The year in which you earn the income (e.g., 2024–25).

Assessment Year (AY): The year after the FY, in which your income is assessed and taxed (e.g., AY 2025–26).

Don’t confuse the two while filing your return!

1.4 Gross vs Net Salary

Gross Salary: Your total earnings before deductions.

Net Salary: The amount you take home after TDS, PF, professional tax, and other deductions.

Alt text: Basic Tax Terms on Salary Slip

2. Key Tax Concepts for First-Time Earners

Now that you're familiar with the terms, let’s look at the key concepts that help you make sense of your taxes.

2.1 Taxable Income

This is the portion of your income on which you actually pay tax. Your gross income is reduced by eligible exemptions and deductions to arrive at your taxable income.

Example:

If your annual salary is ₹6,00,000 and you claim deductions of ₹1,50,000 under Section 80C, your taxable income becomes ₹4,50,000.

2.2 Income Tax Slabs

Income tax in India is progressive—higher income means a higher tax rate.

For FY 2025–26 (New Regime) (According to the Union Budget 2025)

Income Range | Tax Rate |

Up to 400,000 | Nil |

₹4,00,001 – ₹8,00,000 | 5% |

₹8,00,001 – ₹12,00,000 | 10% |

₹12,00,001 – ₹16,00,000 | 15% |

₹20,00,001 – ₹24,00,000 | 25% |

You have the option to choose between:

1. Old Tax Regime: Higher tax rates, but you can claim various deductions.

2. New Tax Regime: Lower tax rates, but most deductions are not allowed.

2.3 Exemptions and Deductions

These help reduce your taxable income.

Exemptions: Portions of income not taxable (e.g., HRA if you live in a rented home).

Deductions: Amounts you can subtract from your total income (e.g., Section 80C for investments).

2.4 Corporate Taxes Explained

While you may not file as a company, you still face indirect corporate taxes as an employee:

TDS deducted by employer

Employer contribution to EPF

Taxable perks like HRA, bonuses, or stock options

Professional tax deducted by state governments (in some states)

💡 Tip: Your CTC (Cost to Company) includes these, but your take-home salary is lower due to these tax components.

2.5 Section 80C and Other Deductions

Section 80C allows you to reduce taxable income by investing in:

Employee Provident Fund (EPF)

Life insurance premiums

Tax-saving FDs

ELSS mutual funds

Principal repayment of home loan

Maximum deduction: ₹1.5 lakh per year.

Other sections to know:

80D – Health insurance

24(b) – Home loan interest

10(14) – HRA exemption

2.6 HRA (House Rent Allowance)

If you live in a rented house and get HRA, you can claim an exemption.

You'll need rent receipts or landlord PAN for claims above ₹1 lakh.

3. Meet the Forms: Your Tax Filing Toolkit

3.1 What is Form 16?

Think of Form 16 as your salary’s tax report card. It’s a certificate from your employer that shows:

How much you earned

How much TDS was deducted

What exemptions you claimed

It has two parts:

Part A – TDS summary and PAN details

Part B – Salary breakup, deductions, and net taxable income

📝 Always ask for Form 16 when you leave or join a new company mid-year.

3.2 What is Form 26AS?

This is your Tax Credit Statement, available on the Income Tax Portal.

It shows all the TDS deducted under your PAN

Helps you verify whether TDS by employer/bank was deposited correctly

Before filing, always cross-check your Form 16 with Form 26AS.

3.3 Form 12BB

When your employer asks for investment proofs (for 80C, 80D, HRA, etc.), you declare them in Form 12BB.

Submit it during the financial year to reduce TDS burden.

3.4 Form 10BA

If you're claiming HRA without receiving a house rent allowance from your employer, you’ll need to submit this form.

4. Filing Taxes for Beginners

Now that you’ve learned the terms, seen the forms, here’s how you actually file.

Step-by-Step Guide:

Collect Documents

Form 16

Salary slips

Rent receipts, investment proofs, insurance documents

Log in to the e-filing portal

- Using a step-by-step guide for the new income tax portal

Register using your PAN

Download Form 26AS

Go to “View Form 26AS”

Ensure all TDS is reflected correctly

Select the correct ITR form

Most salaried employees file ITR-1 (Sahaj)

Pre-fill and Review

The portal fetches most details for you

Confirm salary income, TDS, and deductions

E-Verify

Use Aadhaar OTP, Net banking, or Demat account to verify

5. Managing Taxes for Family Income

If you're going to handle taxes for your parents, spouse, or even siblings:

1. Clubbing of Income

If you invest in a spouse’s name and the investment generates income, it may be added to your income — this is called clubbing.

2. Senior Citizen Benefits

Parents above 60 years may qualify for:

Higher exemption limits

Deduction on interest income under Section 80TTB

Deduction on medical expenses under Section 80D

3. HUF (Hindu Undivided Family)

If your family has a HUF setup, income earned in the name of HUF is taxed separately. Useful for joint family business income and tax planning.

4. Gifting and Taxes

Gifts to family members are mostly tax-exempt. However, any income earned on those gifts may still be taxable under clubbed income rules.

👉 File a separate return for each person who earns taxable income.

6. Common Mistakes to Avoid

Not declaring freelance or side income

Missing deduction proofs (rent, investments)

Using wrong ITR form

Ignoring Form 26AS

Delaying filing beyond due date

Now Handle Taxes Right

Your salary is more than a number on a payslip — it’s the foundation of your financial life.

From understanding TDS meaning to knowing what is Form 16, and then the steps to filing taxes as a beginner with tax planners, you’re now equipped with the basics.

Whether it's your own salary or a family member’s income, a little tax knowledge goes a long way.

tds meaning | 40,500 | 2 |

what is form 16 | 22,200 | 3 |

taxes for beginners | 20 | 1 |

corporate taxes explained | 40 | 1 |

filing taxes for beginners | 10 | 1 |

New to Taxes? Understand TDS, Form 16 & Filing Basics Easily | Pyng

Learn the essential tax terms like TDS and Form 16, understand the process of filing your first return, and explore the new income tax portal in a beginner-friendly guide.