You're already putting in the effort—chatting with clients on Instagram, following up on WhatsApp, and delivering real value. And when it's time to get paid, you simply share your GPay or UPI ID and move on.

The payment comes through. The work gets done. But on your professional profile?

Nothing changes.

No review.

No record of the transaction.

No sign that the service even happened.

And that’s exactly where growth gets stuck.

Because while you’re doing all the right things, one place where’s potential is untouched is your Pyng profile, that isn’t reflecting your work. And that means potential new clients—who could be discovering you—aren’t getting the full picture.

It’s not just about collecting money. It’s about building a presence.

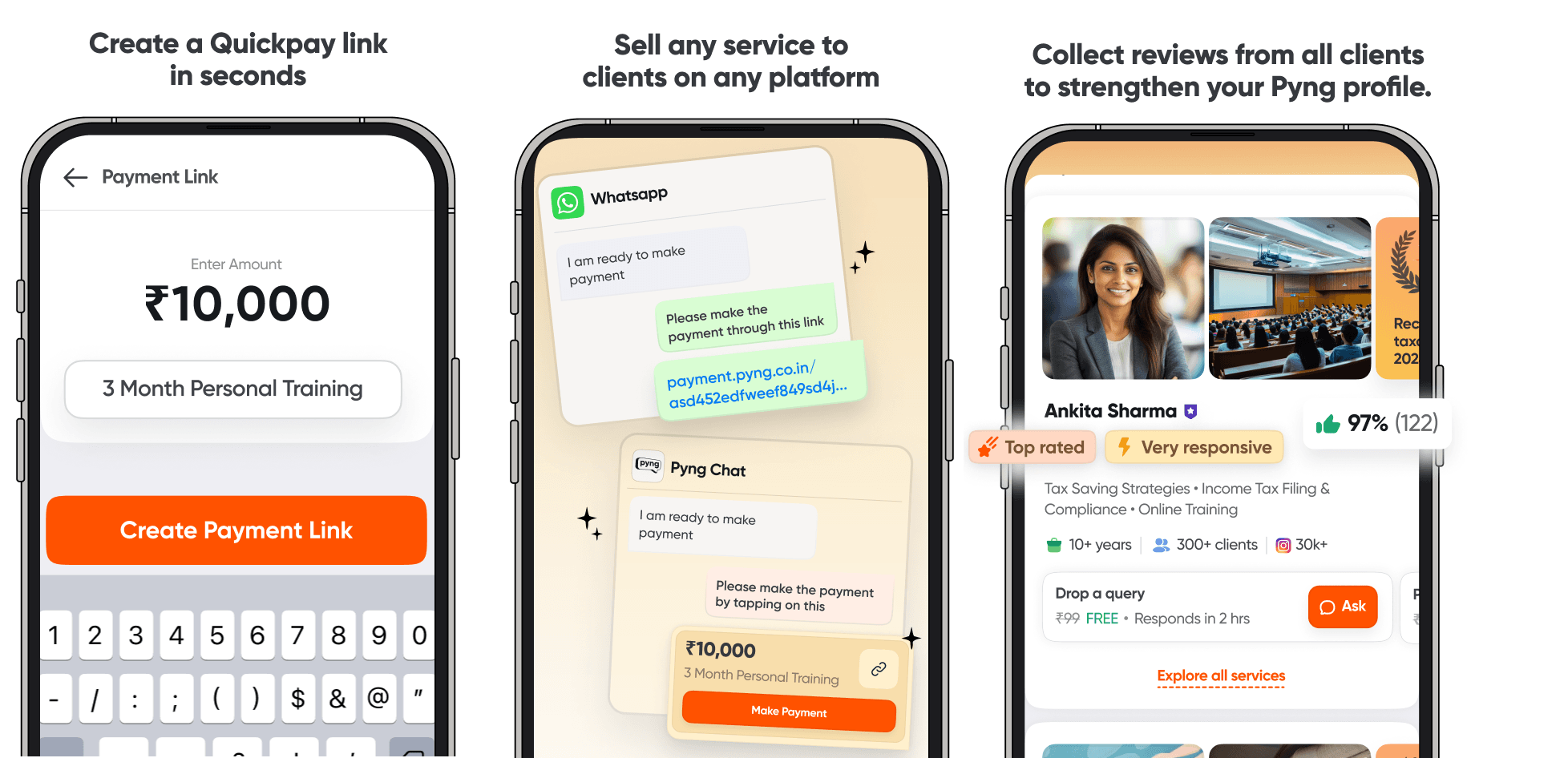

That’s where Pyng’s Quick Pay feature comes in.

What Is Quick Pay, and Why Should You Use It?

Quick Pay is a feature inside the Pyng Professional App that lets you generate a payment link. You can customize the service name and price, then share the link with any client—on Pyng Chat, Instagram, WhatsApp, or anywhere else.

When your client clicks and pays through the Quick Pay link, everything stays within Pyng. The payment is recorded, the order is tracked, and once the service is completed, the client is gently prompted to leave a rating and a review.

You’re not doing anything extra—you’re simply choosing Quick Pay instead of Google Pay or UPI that helps your profile grow along with your business.

What Happens When You Use GPay or Direct UPI?

The most common payment method for experts working off-platform is UPI or wallet apps like GPay and PhonePe. It’s familiar. It works.

But it keeps you invisible on Pyng.

When payments happen off-platform:

You lose the chance to collect a review

Your Pyng profile doesn’t reflect that order

You miss out on higher rankings

You reduce your chances of being discovered by new clients

So while the money might come in, the long-term benefit is lost. Your work isn’t visible to others—and it doesn’t help you grow your reputation.

Your Pyng Profile Is More Than Just a Page

Think of your Pyng profile as your digital storefront. It’s where old clients return and new ones explore. Whether someone found you on social media or through search, one thing is certain—they will check your profile before they book.

And what they see there matters.

Clients want to see proof. Reviews. Recent orders. Signs that others have trusted and booked you. A profile with activity, ratings, and completed transactions naturally builds confidence. And when confidence goes up, so do conversions.

Quick Pay ensures that each successful transaction feeds your profile, making it more credible, more complete, and more likely to show up in search results on Pyng.

Quick Pay Turns Each Client Interaction Into Growth

Switching to Quick Pay doesn't require any change in how you deliver your service. It just changes how you collect payments—so the effort you’re already putting in starts working for you.

Every payment made through Quick Pay:

Is recorded as an order on Pyng

Can be tracked from your dashboard

Automatically prompts the client to leave a review

Improves your ranking in your category

Increases the chances of being discovered by new clients

The more you use it, the more your profile begins to reflect the full picture of your business.

Real Experts, Real Results

Experts across different fields are using Quick Pay not just to collect payments—but to simplify work, build trust, and grow their presence on Pyng. Here’s how real professionals are making it work:

Nutritionist

One expert revised the consultation fee from ₹600 to ₹400 based on a client’s request over chat. A Quick Pay link made it easy to collect the updated amount, even though it wasn’t listed in the catalog. Later, the same client booked a 1-month plan for ₹2,100 through another Quick Pay link. Everything stayed smooth, organized, and visible for both client and the professional.

Designers & Creators

An app designer collected ₹71,500 from a single client through four separate Quick Pay links, as the project progressed in phases. The flexibility made it easy to manage work and still reflect every transaction on the profile—adding both credibility and momentum.

Fitness & Wellness

A fitness coach collected ₹15,200 from an offline client via Quick Pay. Because the payment showed up as a booking, it helped improve visibility and ranking on Pyng—turning real-world sessions into digital growth.

A therapist also chose to offer a reduced fee—₹600 instead of ₹800—for a client in need. Quick Pay made it easy to share a custom price while keeping the payment and review linked to the profile.

Events & Hosting

An anchor/emcee collected a ₹1,000 advance via Quick Pay, with the balance to be paid after the event. The whole transaction stayed professional, trackable, and trust-worthy—no confusion, no back and forth.

Getting Started Is Simple

Using Quick Pay is supereasy.

Open the Pyng Seller App, go to the Orders section, and tap "Generate Quick Pay Links" Enter the amount and the service name, then generate the link. You can share it on Pyng Chat, Instagram, WhatsApp—anywhere you’re already talking to your client.

Once they pay, the order reflects on your dashboard, and the system prompts them for feedback after delivery. Payouts are released after 24 hours, giving both you and your client a safe, reliable experience.

Your Profile Grows When It Reflects Your Work

If you're serious about building a strong presence on Pyng—not just for one-time clients, but for future discovery, long-term credibility, and referrals—Quick Pay is essential.

It takes the work you’re already doing and makes sure it counts. It helps your profile tell the full story. And it brings more trust, more visibility, and more clients your way.

So the next time a client is ready to pay—pause before sending your UPI. Send a Quick Pay link instead.

Let every payment strengthen your presence. Let your profile grow with your business.

Try your first Quick Pay link today, right from your Pyng Seller App.